Product Name: Deliver Correct Real Estate Market Valuation and Property Tax Appeal Course for Residential and Business Real Estate

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Deliver Correct Real Estate Market Valuation and Property Tax Appeal Course for Residential and Business Real Estate is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Description:

Lowering Your or a Client’s Property Tax!

Also Is A Highly Rewarding Residential, Commercial, Industrial Property Tax Consulting Business

In A Multi-Trillion Dollar Industry

(Click Here) Access

Real Estate Appraisal and Property Tax Consultant Residential & Commercial Courses

Using Correct Real Estate Market Valuation for residential and commercial businesses need to correct egregious over-assessed properties and tax overpayments due to

faulty municipal assessments.

Help others not to over-pay, just pay the proper property tax assessment that they should be charged. Your future clients are being squeezed enough, they should NOT overpay! Experts tell us that over-assessed properties excesses range from 40% to 60% (click underlined for verification).

You will be able to give near-certainty guidance to clients in order to pay exactly what they should be charged, NOT OVER-PAY!

It’s step-by-step and you are encouraged to take on cases from the very beginning so you’ll earn as you apply those specific adjustments to a particular client.

With easy to understand training, you will be able to help clients lower their tax and set their record straight. In the process of helping the client, you earn sizable commissions. Good news:clients are easy to find!

Homeowner’s (and businesses) when they get their tax bill are often taken back by the amount charged! The fact is: Most DON’T KNOW that they are over-charged!

The over-assessed desperately need a Property Tax Assessment Review Service that has their back!

It helps customers who have a tax-reduction case shave-off serious amount of money off their tax bill. Any client who is suspicious of their property tax welcomes your help.

Evaluate the Residential and Commercial Property Tax Reduction Business and Earn Fees with Your First Client

A growing numbers of homeowners and businesses will doubt the accuracy of their assessments and desire to appeal their property taxes!

Rectify a tax injustice and give the customer the property tax break they deserve. In turn, you are rewarded out of that tax reduction by way of a contingency fee that can carry over into subsequent years. Besides feeling great about helping others, this is highly lucrative.

This contingency carryover means you’re rewarded multiple times for the same hours of work. Besides getting rewarded monetarily, you will enjoy helping your client out of an unfair assessment jam. Check out the process!

Extremely Useful Free house appraisal and property tax appeal forms. The forms are PDF downloadable and provide a generic template to organize your information in an acceptable format so you can present your evidence in good style. It is similar to that used by licensed real estate appraisers. You’ll be given the password to access this information shortly after your order.

Invaluable Sample Fee Agreement Forms, Fill In Fee Agreement Form, Sample Advisor/Agency Authorization Form, Fill In Advisor/Agency Authorization Forms, Residential Solicitation Letters, Signed Contract Transmittal Letters, Thank You For Choosing Our Company Letters,

Limited Power of Attorney Form, We Have Filed Your Appeal Letters, Invoice Form For Services Rendered, Enclosed Is Your Invoice Letters, Past Due Notice Letters ….

Invaluable This is the ins and outs for making this business work. All the methods, advice and tactics you’ll need to fast-track this business. You learn how to set up your business and learn how to go about marketing your business to a huge population of potential clients.

Invaluable Keep yourself updated with the latest research and property tax appeal advice for life.

Package #5 (included in course)

Pre-written, ready to use

Persuasion Tactics & Persuasive Salescopy Ebook 110 Pages …

Useful The Power Of Words Can Make You Rich. If you can’t persuade people to buy your products, you’re going nowhere. Ever think that maybe that missing piece is knowing how to write persuasive copy to your customers? Could the only thing standing between you and a much larger success be just good marketing copy? (click business sales letters and copy writing for more detailed information)

Gain Unlimited Clients – Earn Unlimited Fees!

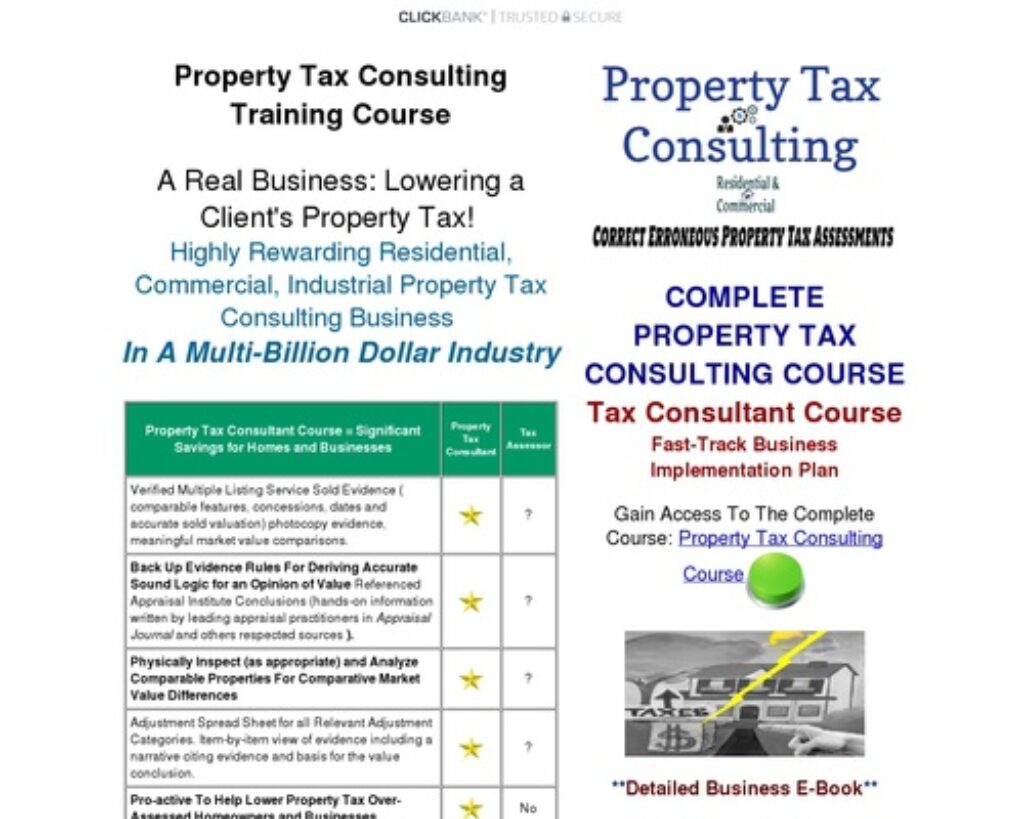

THE COMPLETE

REAL ESTATE APPRAISAL & PROPERTY TAX CONSULTING COURSE

Property Tax Consultant Residential & Commercial Courses

Fast-Track Business Implementation Plan

Gain Access To Complete Courses for

Real Estate Appraisal For Residential & Commercial Property Tax Appeal: Property Tax Consulting Course

**Detailed Business E-Book**

Free Real Estate Appraisal & Property Tax Consultant eBook Business Overview Guide

Click Upper Left Box To Access

FREE Property Tax Consultant Course & Business Plan

**Detailed Start Up Business E-Book**

Residential/Commercial Property Tax Consulting Course

Where You Will Earn as you Learn

It’s good to keep friendly relations with the tax assessor since one can

re-appeal their case as often as is necessary with new evidence any time

during the year and win. That case can be a residential or commercial

property tax appeal.

HELPING OVER-ASSESSED VICTIMS

Prepare for those months. EXTREMELY PROFITABLE since few if any property tax consultant specialists likely work within your zip code.

COMPLETE PROPERTY TAX CONSULTING COURSE

Tax Consultant Course a Fast-Track Business Implementation Plan

Gain Access To The Complete Course: Property Tax Consulting Course

100% beginner friendly – no tech skills or experience needed.

Bank 4 figures in contingency commissions per appeal even if you’ve NEVER made a dime consulting.

The easiest & FASTEST way to earn contingency commissions helping the over-assessed.

EARN as you learn property tax appeal consulting.

Set your own contingency fees.

Get Full-Access to a foolproof turnkey system on how to Successfully Appeal Property Taxes and cash into the money almost every single time you take on a client.

Taking the Property Tax Consultant Business Course will help you learn how to dominate an industry With Little to No Competition.

Discover how to earn large contingency fees, even one-time equalization processing fees from prospects and get Multi-Referrals.

Earning LARGE FINANCIAL REWARDS learning as you go by a step-by-step process & building a Property Tax Review Business.

Earning likely a few thousand dollars on each prospect by simply engaging on their behalf in a property tax appeal.

I graducated with a degree in Real Estate (Eastern Michigan University) and this course was a great Real Estate Appraisal course, better than in College.

Purchased your Property Tax Consultant course last year and just as you predicted we are well in our way to a healthy six figure income. My partner and I created a CRM application (JASO)- to process our pipeline in a seamless fashion (from client intake to productivity analysis) – this databases has been key to us in touching base with our customers on a timely manner as well as organizing every facet of our business – we see the value that JASO has been for us and recognize how valuable this could be for other Property Tax Consultants alike.

Currently the application is tailored for Florida however we are updating and customizing the CRM application to be relevant nationwide. We would love to market our product to your distribution list; if we could speak more in depth on the topic, I believe we can come to an understanding that is worthwhile for all parties involved, I look forward to hearing from you soon. Have a wonderful day and a pleasant weekend.

Sincerely, Michelle M

Sincerely, Michelle M

Fees are charged on a contingency basis, which means, if you lose the case, the client risks nothing. Since there is no risk to the client or homeowner, they want your service. Finding potential clients is mind-blowing simple. Some charge an up-front consultation fee. Many do.

Basically, the real estate appraisal system is rife with errors. Valuations are constantly in flux and the tax assessors office rarely does personal valuation visits. They leave it to other blanket assessor services. This is just the tip of the iceberg and it opens the door for a business opportunity that really helps others in a meaningful way.

When a valuation for an jurisdiction is required, the town sets out on a public bid and generally the lowest bidding property valuation broker wins. You can bet your bottom dollar that the broker who won the bid needs to make a profit.

Little time and money is allocated on a per unit basis for the appraisal. Sometimes a raw crew is doing the work. There are time restraints on his crew in order for the mass evaluations broker to earn his profit. Errors are rampant. Therefore a dire need for appealing over-assessment errors.

Helping homeowners as well as commercial accounts lower their property tax is a legitimate business that generates financial rewards.

In this day and age, those who can use some extra income can work this service as a work-from-home based business or an add on part-time business.

Since there is no free lunch, it can be worked in conjunction with another income stream such as the mortgage brokerage trade, real estate, insurance and similar consulting industries. It can be worked during slow times or just to do something challenging and different to help turn the table by helping correct regulatory errors.

Residential property tax appeal opportunities abound. You’ll find you’ll never run short of finding bad assessments to correct not to mention those referrals looking to reduce their property tax over assessment.

Expert studies indicate that the percentage of assessment error exist is high. It’s clear as a bell that you’ll never lack clients.

As long as property taxes are levied and that real estate market valuations fluctuate, you’ll find an over-abundance of cases where the assessment valuation against a homeowner is flat out wrong. Championing that tax appeal is an opportunity to be of great service.

The bigger the tax bill, the greater the reward.

The commercial side of the business deals with larger properties and, needless to say, larger commissions. Commercial valuations are based on an Income Approach. If they earn less net income than the previous year, their property tax assessment should be less. You’ll learn about the opportunities that exist in this area of specialization.

Strip malls lacking tenants may need to appeal an old assessment. Apartment house and complexes vacancies, many small to medium businesses that might be suffering could file appeals when the facts warrant. Again, a business valuation is based not on a Market Value Approach but on an Income Approach.

Fact is, unlike residential properties which use a comparable property approach, a commercial property valuation is made on an income basis. And guess what? If cash flow to the commercial property is lacking business or tenants, you might have found a client who could use significant savings!

Give others the tax break they deserve. Provide a service where practitioners are scarce and the results are valuable.

THE COMPLETE

REAL ESTATE APPRAISAL & PROPERTY TAX CONSULTING COURSE

Property Tax Consultant Residential & Commercial Courses

Fast-Track Business Implementation Plan

Gain Access To The Complete Courses for Residential & Commercial Property Tax Appeal:

Property Tax Consulting Course

100% Iron Clad 56 Day Money-Back Guarantee

If within 56 days, you review the entire Property Tax Consultant package, and you feel this does not do all that we said it would do for you and more, simply contact us and we will process your refund. It’s that simple. That’s right, if you think the Property Tax Consultant package does not live up to your expectations, you won’t be out one red cent! Send us an email and we’ll refund your purchase…

Once one has a client the next step is to find comparable properties with a similar footprint that sold recently. The best and fastest and free place for that is through the Multiple Listing Service SOLD directory from a local real estate agency. Their computer will spit out 10 or more comparable properties. Then cherry pick the best 3. Online, in most towns, one can access the property record cards getting exact recorded details (where one might find recorded facts to be in error). Then it’s just putting gathered information together to make your case.

Your first Guarantee: You have TWO full months to examine everything, use what you wish, and, if for any reason or even no reason, you want a full refund, just return everything and you’ll get your money back immediately. NO questions asked. You do not need a ‘my dog ate my homework story’. No one will ask you any questions at all. No hassle. No ‘fine print’. Simple and straightforward; you are thrilled with what you get or you get a full refund. I’m devoted to the goal of only having satisfied customers. If you’re not going to profit from having my System, I really would prefer to buy it back.

My sole purpose in offering this course is for bringing social justice to those over-assessed. To correct wrongs. Many tax assessors view their job as preserving the tax base and are not pro-active in helping over-assessed victims. The fact is that over-assessment errors are excessive and need to be addressed. Assessment bureaucrats need to be shown the facts and if they turn a blind eye, there are two more avenues of appeal: The Municipal Appeal and the State Appeal. We need activists who will stand up against the bureaucrats and with the right evidence, you will win.

I want you to put hundreds of thousands of dollars into your bank account in the course of the next ten or twenty years with this professional Property Tax Consulting Home Consulting Course.

(Click Here) Access

Real Estate Appraisal Property Tax Consultant Residential & Commercial Courses

FREE Tax Consulting E-Book Overview Explains:

Explains how using as well as provides the Right Forms and Marketing Tools making sign ups easy and the process almost Formulaic.

Scan the FREE E-Book. The E-Book covers both residential and the commercial side of property tax appeals. You’ll learn about the ins and outs of this little known work from home consulting business practice. It is one of the top work from home business ideas worth exploring. This is a service that many homeowners and businesses desperately need.

It can be extremely lucrative to engage in all types of appeals, both residential and commercial property tax appeals.

Details on Everything: Errors within the assessment system offer an opportunity to put a significant amount of dollars back into your clients wallet. You help aid the real estate taxpayer’s bottom line.

Without further ado, the ingredients needed to prepare successful residential property tax appeals & many types of commercial property tax appeals and how to market this kind business are explained. Nothing held back. Or, if you’re ready to Gain Access To The Complete Course: Click: Property Tax Consulting Course

For a limited time, we are offering this free report. Since this could be something you might be interested in discovering and looking into further … click below to get a deeper look into the Property Tax Consulting Business.

Property Tax Consulting 100% FREE Business Plan E-Book

Get the FREE Download to see what some average appeal reduction ranges are and an overview of this kind of business opportunity.

Give others the tax break they deserve and discover a service that where practitioners are scarce.

<-- An over-assessed property taxpayer who did not appeal his property tax ... years down the road!

The difference someone with property tax consultant training could make for others is astonishing!!

Why Become A Property Tax Consultant? First off, you’ll never lack for business – there are numerous incorrectly assessed properties and too much for anyone to handle.

Millions of property owners need this service. Estimates for incorrectly assessed properties range from 40% to 60% often due to sloppy government guided assessment procedures or just rolling over previous assessments.

It’s not very complicated to learn and can be worked as a work from home business. Fifth grade math (addition, subtraction, a little multiplying and division), sixth grade English skills. The logic speaks for itself.

With a large number of homes and businesses having glaring property assessment errors, honing in on good candidates for high-percentage, high dollar amount wins is not difficult.

Property Tax Consulting Course

100% GUARANTEED To Work!

Click Below for FREE Overview eBook.

Free Described Property Tax Consultant eBook Business Overview Guide

Click Top Left Box For Free Access

RISK STATEMENT: I have not heard or seen any property taxes raised because of an unsuccessful appeal, however that does not preclude that possibility.

The chance of winning a property tax appeal using proven adjustment techniques, evidence and standard adjustment parameters drastically improve winning that appeal. Nevertheless, there is no guarantee of a win.

The tax assessor has the power to reduce your or your client’s property tax based on the evidence presented. One can reschedule meetings with the assessor as necessary in order to prove your adjustments for a lower tax. If the tax assessor doesn’t reduce the tax, the next avenue of appeal is to the Municipal Court of Appeals. If that fails, the final avenue of appeal is the State Tax Court which likely meets at the county level.

Again, no guarantee, but if your evidence is good, and makes sense, you should win your case every time.

LEGAL: While it has been proven by many of our customers that you can generate income very quickly with this information,

please understand that what you are buying is in fact INFORMATION and not a promise of riches or financial gain.

What you do with this information is up to you.

Real Estate Appraisal and Property Tax Consultant Home Business Home Page

Contact | Privacy Policy | Terms Of Service | Disclaimer | Earnings Disclaimer

Question and Answers about this consulting business Home Business Q & A

State Dates | Business Letter | Home Business Opportunity Press Release

Home Businesses | Claims Processing Judgment Recovery Business

working at home | Categories of Tax Consultancy | Real Estate Business Ideas

Electronic Appraiser | Property Tax Consulting Overview | Property Tax Consulting Course | Commercial Property Tax Consulting Course

Small Business Owner | Online Tax Courses | Consulting | Expert Witness Testimony | Property Tax Course | Property Curb Appeal | Areas For Tax Adjustments

Property Tax Appeal Adjustments and Courses

Property Tax Appeal Business

Note: As far as known, the state of Texas is the only state in the union where a license is required to engage in property tax consulting. See Texas Department Licensing Regulation

Work From Home Businesses – Start Your Home Base Business … Online Tax Course: Property Tax Consulting Home Business Package

© Copyright – PropertyTaxConsult.com – All Rights Reserved

//

[ad_2]

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Deliver Correct Real Estate Market Valuation and Property Tax Appeal Course for Residential and Business Real Estate is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.