This is day 19 of our 30 day series “30 Simple Things to Do to Change Your Life in 30 Days. If you missed a day, links to previous articles follow this article.

Money can be a major source of stress for many of us, whether it’s worrying about bills, debt, or simply trying to make ends meet. But what if I told you that a little bit of planning can transform how you feel about your finances? It’s time to stop fearing your budget and start befriending it. By creating a financial roadmap, you’ll not only gain control over your money, but you’ll also reduce stress, make room for more freedom, and set yourself on the path to achieving your financial goals.

On Day 19 of our 30-day journey to change your life, let’s dive into the power of budgeting and how it can help you reclaim control over your financial future.

Why You Need a Budget

A budget isn’t about restricting yourself; it’s about giving you freedom. Many people avoid creating a budget because they see it as a limitation, but the opposite is true. A well-designed budget helps you allocate money to the things that matter most while avoiding the stress of overspending or living paycheck to paycheck.

By keeping track of your income and expenses, you can:

Gain Clarity: Know exactly where your money is going each month. Once you understand your spending patterns, you can make informed decisions about where to cut back or invest.

Achieve Financial Freedom: A solid budget helps you avoid unnecessary debt, build savings, and work towards financial independence. When you have a plan, your money starts working for you instead of the other way around.

Reduce Stress: Financial uncertainty is one of the leading causes of anxiety. With a clear roadmap in place, you’ll feel more in control and less worried about unexpected expenses.

Reach Your Goals Faster: Whether it’s paying off debt, saving for a vacation, or buying a house, a budget lets you see exactly how much you need to save and by when. It creates a realistic timeline for achieving your dreams.

How to Start Your Budget

Creating a budget doesn’t have to be complicated. Here’s a step-by-step guide to making your own financial roadmap:

Assess Your Income

Start by taking stock of all your sources of income. This could include your regular salary, freelance work, side gigs, or passive income from investments. Knowing your exact monthly income gives you the baseline for your budget.

Track Your Expenses

Next, list all your monthly expenses. This includes fixed expenses like rent or mortgage payments, utilities, and debt repayments, as well as variable expenses like groceries, entertainment, and dining out. You’ll also want to account for irregular costs, like car maintenance or holiday gifts.

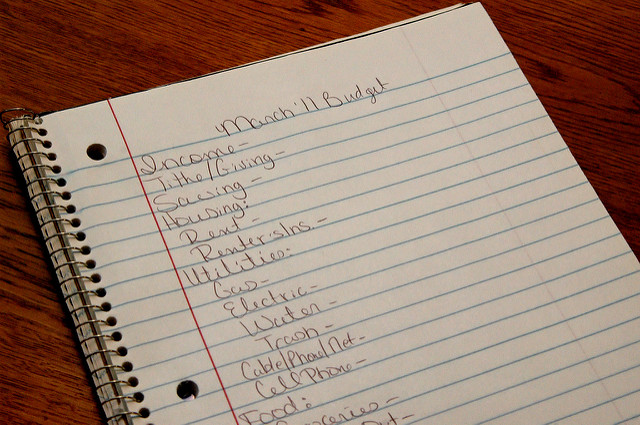

You can use budgeting apps like Mint or YNAB (You Need A Budget) to track your expenses automatically, or you can keep it simple with a spreadsheet or a notebook.

Separate Needs from Wants

Now that you have a clear picture of your income and expenses, categorize them into needs (essentials like housing, utilities, and food) and wants (non-essentials like dining out, subscriptions, or shopping). This will help you identify areas where you can cut back if necessary.

Remember, the goal is not to eliminate all the fun things in life but to create balance and ensure your spending aligns with your financial goals.

Set Clear Financial Goals

This is the most important part of your financial roadmap. What do you want your money to achieve? Do you want to build an emergency fund, pay off debt, save for retirement, or plan for a major purchase? Setting clear, actionable goals gives you something to work towards.

Make sure your goals are SMART (Specific, Measurable, Achievable, Relevant, and Time-bound). For example, instead of saying “I want to save more money,” set a specific goal: “I want to save $5,000 for an emergency fund by the end of the year.”

Create a Plan for Your Debt

If you have debt, prioritize it in your budget. There are two popular strategies to tackle debt:

Debt Avalanche: Pay off the debt with the highest interest rate first while making minimum payments on the rest.

Debt Snowball: Focus on paying off your smallest debt first, giving you a psychological boost as you eliminate balances one by one.

Whichever method you choose, be consistent. Reducing debt is key to financial freedom and less stress.

Adjust Your Spending

Once you’ve accounted for your essentials, allocated money toward your goals, and planned for debt repayment, take a look at your discretionary spending. Are there areas where you can cut back? Small adjustments—like cooking at home more often or canceling unused subscriptions—can free up money for your savings and financial goals.

Plan for Savings

Every budget should include room for savings, even if it’s a small amount each month. Prioritize building an emergency fund that covers 3-6 months of living expenses, so you’re prepared for unexpected financial setbacks.

You should also set aside money for long-term savings, like retirement or future investments. The earlier you start, the more you’ll benefit from compound interest.

Review and Adjust Regularly

A budget is a living document that changes as your financial situation evolves. Make it a habit to review your budget every month to ensure you’re staying on track. If you receive a raise, incur new expenses, or your goals shift, adjust your budget accordingly.

Simple Tools to Help You Stay on Track

There are countless tools available to help you stick to your budget and financial goals. Here are a few that can make budgeting easier:

Budgeting Apps: Apps like Mint, YNAB, and EveryDollar help you track expenses, set goals, and stay within budget. They offer user-friendly interfaces and real-time updates.

Envelope System: A tried-and-true method, the envelope system involves allocating cash for each spending category (e.g., groceries, entertainment). Once the cash is gone, you stop spending in that category for the month.

Automatic Transfers: Set up automatic transfers to your savings account or debt payments. This ensures you’re saving or paying down debt without having to think about it.

The Ripple Effect of Budgeting

The beauty of creating a financial roadmap is that it doesn’t just impact your wallet—it impacts your overall well-being. Knowing exactly where your money is going reduces financial stress and increases your confidence. You’ll have more peace of mind, more freedom to enjoy life, and more power to pursue the things that truly matter to you.

When you stop worrying about your finances, you’ll notice that other areas of your life improve too. You’ll sleep better, experience less anxiety, and have more mental space for creativity, productivity, and joy.

Conclusion: Befriend Your Budget Today

Budgeting isn’t about deprivation; it’s about taking control. When you create a financial roadmap, you’re not just managing money—you’re designing your future. With clear goals, a plan for your debt, and room for savings, you’ll feel empowered and in control of your financial destiny.

If you’ve been avoiding your budget out of fear or uncertainty, now is the time to change that. Take a few minutes today to sit down with your finances and create a budget that works for you. By doing so, you’re taking a big step toward financial freedom, less stress, and a brighter future.

Previous articles in this series can be found here:

This post is exclusively published on eduexpertisehub.com

Source link